April & May in summary

April was a positive month for the global economy with growth remaining remarkably resilient in the face of higher interest rates

April was a positive month for the global economy with growth remaining remarkably resilient in the face of higher interest rates

Equity markets continued their rally and have now broadly recovered from the tumult in March. While near-term recessionary risk seems to have receded somewhat, the closure of another US financial institution at the end of April highlights that the cumulative impact of central bank tightening has still not been fully felt by developed economies. This means that despite the recent improvement in the business surveys, portfolio diversification remains essential in the face of significant recession risk.

Digging deeper into the key factors behind markets movement in these months reveals the following:

Deepening of US banking crisis after several big collapses, rising risks of recession in mid-2023 talks

Deepening of US banking crisis after several big collapses, rising risks of recession in mid-2023 talks

This crisis differs from 2008 market turmoil due to its nonsystemic nature, in other words, the turmoil in the industry has centered on regional banks. Moreover, the crisis was driven by unique factors including large amounts of uninsured deposits and losses on banks' investments in government bonds relative to the size of their capital base, not using some obscure products. So instead of being "too big to fail" in 2008 crisis, now banks are meant to be "too small to thrive".

The banks that failed recently all invested in long-term Treasuries, as a safe haven, but as the Fed embarked on an aggressive rate hiking cycle, the value of these investments fell. When the banks experienced bank runs, they were forced to sell the investments at a loss, leaving them without adequate cash to back depositors' funds. Bank accounts also exceeded the federally insured limit of $250,000, making their deposit bases more vulnerable to flight with any signs of stress.

But investors are fearful that there are more dominoes to fall. One of those dominoes could be PacWest Bancorp. Shares of the bank were down as much as 30% on May after it reported customers recently withdrew 9.5% of its total deposits.

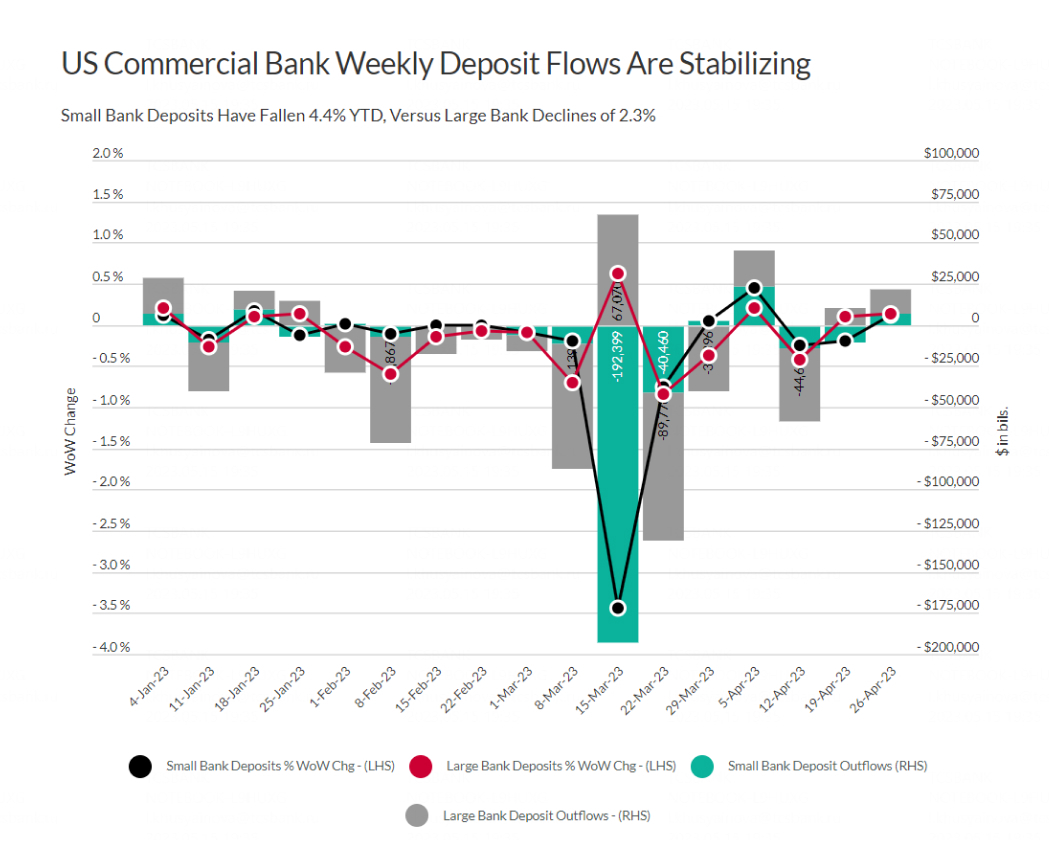

Deposits at U.S. commercial banks year-to-date through April 26 are down 3%, or $494 billion, to $16 trillion, with outflows led by small banks.

Continuation of hawkish stance by central banks

Continuation of hawkish stance by central banks

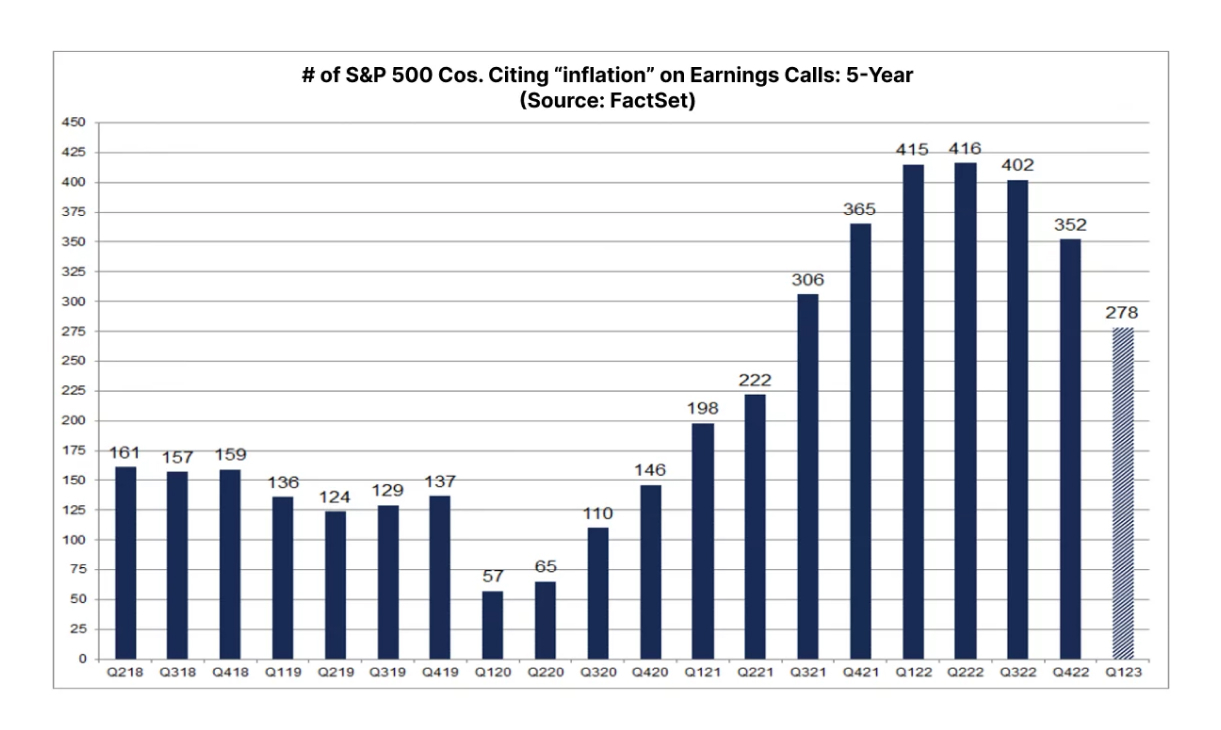

Central banks are deliberately causing recessions by hiking interest rates to try to rein in inflation. Despite recent banking instability, the Fed continues to be more worried about not doing enough to get inflation under control than it is about tightening too much.

April CPI data showed that core goods prices surged and core services inflation excluding shelter stayed sticky through the last three months. That means annual core inflation is running close to 5% in the three months to April — too high for the Fed. Core services inflation excluding shelter did decline in April — but it is nedded to see that decline extend over a longer period to prove that underlying inflationary pressures are easing.

Digging deeper into the key factors behind markets movement in these months reveals the following:

US earnings season: "better-than-feared" results

US earnings season: "better-than-feared" results

To date, 92% of the companies in the S&P 500 have reported earnings for the first quarter. Of these companies, 78% have reported actual EPS above the mean EPS estimate, which is above the 10-year average of 73%. In aggregate, earnings have exceeded estimates by 6.5%, which is above the 10-year average of 6.4%. It is also the highest surprise percentage reported by S&P 500 companies since Q4 2021 (8.1%).

In terms of earnings guidance, 57% of the S&P 500 companies (50 out of 87) that have issued EPS guidance for Q2 2023 have issued negative guidance. This percentage is below the 5-year average of 59% and below the 10-year average of 67%. In terms of revisions to EPS estimates, analysts lowered EPS estimates for Q2 2023 for S&P 500 companies by 0.8% in aggregate during the month of April, which was much smaller than the 5-year average of -1.9% and the 10-year average of -1.8% for the first month of a quarter.

Of course there’s plenty to worry about for the rest of the year, including the potential for recession, tightening financial conditions and debt limit drama. But after earnings season is over the risk of an additional sharp contraction in profit margins has come way down.

US debt ceiling concerns

US debt ceiling concerns

1. US stocks

1. US stocks

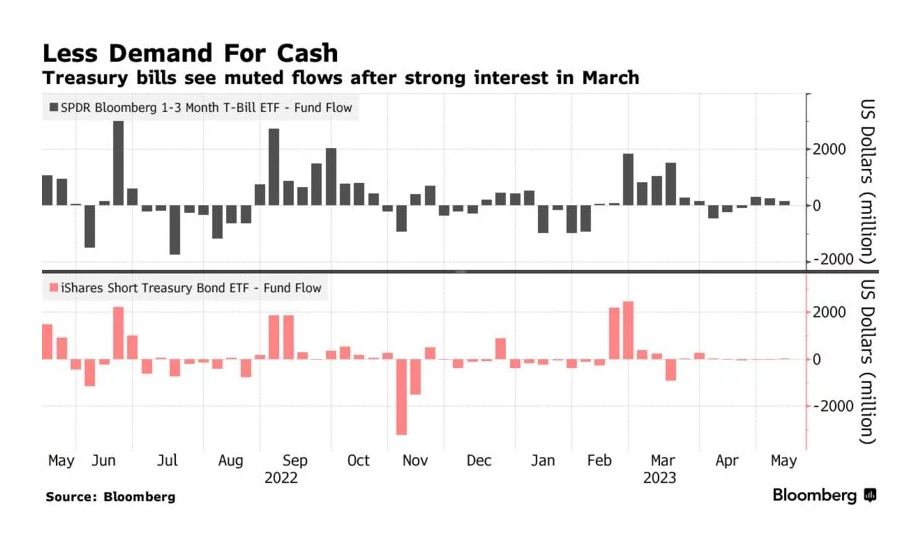

That flood of cash was the product of two factors: higher yields on money market funds as a result of the Federal Reserve’s aggressive interest-rate increases, and worries about the safety of bank deposits following the recent failures of several regional banks. Investors receive 4.7% on an annualized basis in a Fidelity government money market fund for putting their cash in a money market fund today. Interest rates on savings deposits generally rise at a much slower pace.

Investors have pulled $632 billion in deposits from commercial banks since the start of the year through April 26. The failure of another major regional bank in May, First Republic, did not generate a panic and a move to money market funds the way the initial bank failure did.

In May, money market fund assets jumped to a record $5.685 trillion, with a surge of inflows since the collapse of Silicon Valley Bank and Signature Bank in March.

Still, concerns about disruptions from the U.S. government hitting the debt ceiling are showing up in the bond market, where short-term Treasury yields have spiked recently. But money-market funds have a layer of protection through so called "breaking the buck" rule. The funds always keep their net asset value at around $1. At that point, the U.S. could default, meaning it wouldn’t pay the full principal it owes on liabilities such as one-month Treasury debt, which many money-market funds hold. That is why the price of one-month Treasury debt has dropped recently. One-month Treasury yields have risen to 5.5% as of May 10—up from 4.7% at the end of March.

We suspect money market fund flows may remain strong until the US debt ceiling showdown is resolved, confidence in regional bank stability returns and uncertainty regarding a possible US recession and downward earnings revisions is reduced.

2. Bonds

2. Bonds

US Dollar Bonds

US Dollar Bonds

The recent banking sector turmoil in the US has somewhat fuelled market expectations for the Fed to cut rates in 2H23. The Fed still remains highly attentive on inflation risk as the US labour market continues to be strong. Consequently, the UST market may continue to fluctuate over the near term as investors monitor incoming economic data and any contagion effects from the banking crisis.

EUR Bonds

EUR Bonds

3. Gold

3. Gold