Feb-March in summary:

Digest of Vita Markets analysts

22.02.2023

Vita Markets

Hu

En

Download Vita Markets app now

Markets have been volatile since the start of February without any sustained dynamic

Markets have been volatile since the start of February without any sustained dynamic

Equities in the U.S. in China were under pressure, European markets started February relatively strong but eventually edged down in mid-March as banking crisis talks started to spread around. Bonds and gold were under pressure in February as hawkish momentum returned (both USD and EUR), but since the talks of a potential banking crisis began to spread, they rebounded pretty strongly.

Two key factors behind markets movement during this period were:

Two key factors behind markets movement during this period were:

Renewed hawkish stance by the Fed and other Central Banks

Renewed hawkish stance by the Fed and other Central Banks

Despite a strong start of the year when everybody started to cheer on the eventual end to the global monetary tightening cycle, solid economic data in February led investors to believe that there is still some time before that happens. Data showed that the PCE deflator increased in January by 0,6% and the labor market stayed strong with the unemployment rate falling to 3,4%. As a result investors reassessed their expectations for both the peak in interest rates and the subsequent pace of rate cuts and that led to a move higher in bond yields and a decline in equity markets. At one point markets started to discount the Fed rate to reach the level of 5,75−6,00% in mid-2023.

The European Central Bank (ECB), Bank of England and Federal Reserve (the Fed) all announced rate hikes at the start of February, in line with expectations. The broad message that emerged during press-conferences and public speeches was that despite the recent decline, inflation remains too high and the central banks' job is not done yet.

The European Central Bank (ECB), Bank of England and Federal Reserve (the Fed) all announced rate hikes at the start of February, in line with expectations. The broad message that emerged during press-conferences and public speeches was that despite the recent decline, inflation remains too high and the central banks' job is not done yet.

SVB collapse; talks surrounding banking crisis & flight to safety

SVB collapse; talks surrounding banking crisis & flight to safety

Collapse of SVB (Silicon Valley Bank) in mid-March, the 16th biggest bank in the U.S. as of the start of March, led to a significant market turmoil. Depositors started to panic and withdraw their funds from many regional banks as they started to fear that they will not be able to get their money back. To stop the panic, SVB was taken over by regulators, and on March, 13th, US president Joe Biden sought to reassure Americans that their money is safe, vowing to do "whatever is needed" to protect bank deposits. The Fed announced a new funding facility, the Bank Term Funding Program (BTFP), which is supposed to improve the liquidity conditions of banks in the U.S.

Failure of SVB led to a strong flight to safety by the global investors. Global equity markets started to fall down, while standard "safe-haven" asset classes such as gold and US Treasuries were under increased demand. Investors completely changed their forecasts on the Fed rate dynamics as a result of this event — now pricing only one/two 25 bp hikes until the end of 2023, as a hope that the Federal Reserve would act to steady the global financial system. Goldman Sachs even said that it no longer expected any increase at the Fed’s meeting ending on March 22 "in light of recent stress in the banking system". Japanese bank Nomura also said that it was now expecting the Fed to cut interest rates by 0.25 percentage points at its March meeting

Failure of SVB led to a strong flight to safety by the global investors. Global equity markets started to fall down, while standard "safe-haven" asset classes such as gold and US Treasuries were under increased demand. Investors completely changed their forecasts on the Fed rate dynamics as a result of this event — now pricing only one/two 25 bp hikes until the end of 2023, as a hope that the Federal Reserve would act to steady the global financial system. Goldman Sachs even said that it no longer expected any increase at the Fed’s meeting ending on March 22 "in light of recent stress in the banking system". Japanese bank Nomura also said that it was now expecting the Fed to cut interest rates by 0.25 percentage points at its March meeting

1. US stocks

1. US stocks

US stock market was dominated by a FED narrative during the last month. Strong economic data only reassured investors that regulators will keep the direction of aggressive tightening, and corporations hardly had anything good to show in 4Q22 results to compensate for that.

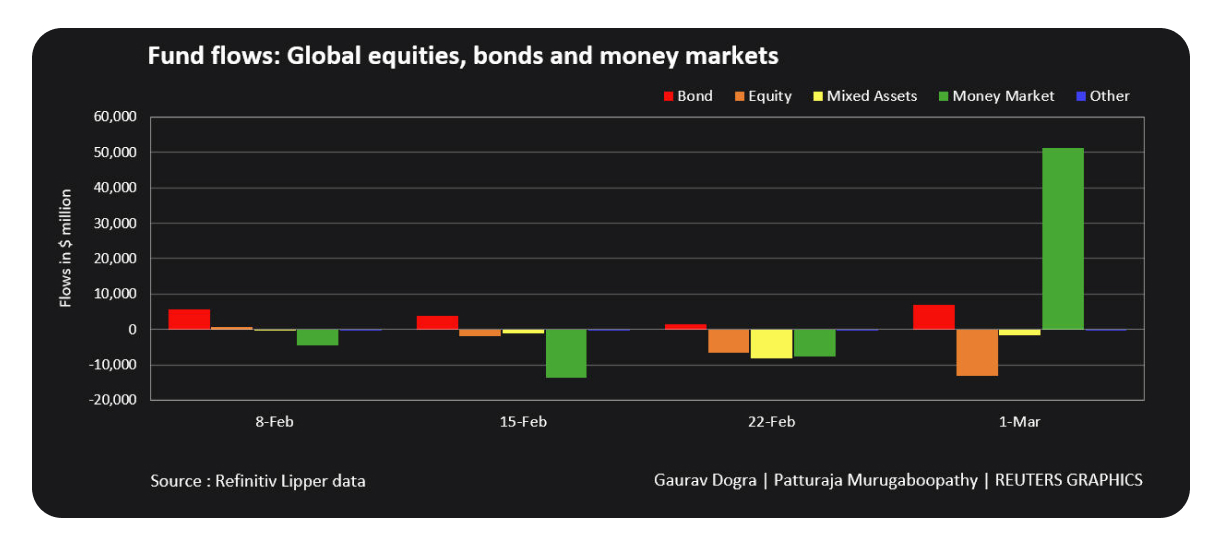

As a result we saw continued outflows from equity funds and record inflows into money market funds.

As a result we saw continued outflows from equity funds and record inflows into money market funds.

Indeed, who would risk holding equity on the brink of recession if you can buy a money market instruments yielding 4+% almost risk free? On the back of this we S&P index slowly slide from end-January peaks even before the regional banking crisis.

The Collapse of SVB bank definitely added a new flavour to the stock market in March. We still don’t know the exact size of that problem. It appears to be a local and relatively isolated risk for now, but the market definitely fears that it might provide a domino effect for the whole banking system not only in US but also in Europe. And that aggressive tightenings by central banks might provide more cracks in the economy than needed, thus lowering chances for soft landing and increasing the possibility of deep recession in the US. Which supports our view on these markets (to remind, we were negative on US stocks since the mid 2022). And supports the case for bonds and gold to be the best performing asset classes in 2023.

If we go into more granular data on market performance, we can see that the weakest performance for the last month obviously was in the Financials, due to the fears of banking crisis spreading to other low and mid-cap banks. Energy was another weak performer, mainly in the back of weakening oil and gas prices — which were down due to the rising expectations of deep recession in the us economy. Staples and utilities are holding better than others, a fact anyone would expect to see in any recession playbook.

The Collapse of SVB bank definitely added a new flavour to the stock market in March. We still don’t know the exact size of that problem. It appears to be a local and relatively isolated risk for now, but the market definitely fears that it might provide a domino effect for the whole banking system not only in US but also in Europe. And that aggressive tightenings by central banks might provide more cracks in the economy than needed, thus lowering chances for soft landing and increasing the possibility of deep recession in the US. Which supports our view on these markets (to remind, we were negative on US stocks since the mid 2022). And supports the case for bonds and gold to be the best performing asset classes in 2023.

If we go into more granular data on market performance, we can see that the weakest performance for the last month obviously was in the Financials, due to the fears of banking crisis spreading to other low and mid-cap banks. Energy was another weak performer, mainly in the back of weakening oil and gas prices — which were down due to the rising expectations of deep recession in the us economy. Staples and utilities are holding better than others, a fact anyone would expect to see in any recession playbook.

Overall though, we expect that there would be no place to hide in stocks in case even some of the risks will materialise, and FED continues to tighten. US stocks have room to fall, but low chances to finish 2023 with growth. And that is the reason investors continue to relocate funds to fixed income instruments.

2. Bonds

2. Bonds

US Dollar Bonds

US Dollar Bonds

In February US bond markets were in a correction due to a more hawkish stance by the Fed. At the beginning of February, the Fed voted to raise rates by 25 bp to 4.75%, but the accompanying statement appeared dovish. Later in the month, however, Fed Chairman Jay Powell warned that further rate hikes are likely needed, especially if macro data continue to come in stronger than expected. The consumer price index (CPI) in January rose at a YoY rate of 6.4% (headline) and 5.6% (core), which was lower than the previous month. As a result all US-bonds were in negative territory in February, with HY bonds falling a little but less than others.

But the failure of SVB led to a strong demand for US bonds in mid-March. As the outlook for Fed peak rate was changed, the yields on U.S. Treasuries declined heavily. As a result, global USD bonds outperformed at the start of March, with IG subclass leading the pack. High-yield bonds were under pressure due to concerns regarding the stability of global financial system

But the failure of SVB led to a strong demand for US bonds in mid-March. As the outlook for Fed peak rate was changed, the yields on U.S. Treasuries declined heavily. As a result, global USD bonds outperformed at the start of March, with IG subclass leading the pack. High-yield bonds were under pressure due to concerns regarding the stability of global financial system

EUR Bonds

EUR Bonds

The ECB raised interest rates by 50bps to 2.5% in February, confirming the intention to “stay the course in increasing interest rates significantly, at a steady pace, and keeping them at levels that are sufficiently restrictive to ensure a timely return of inflation to the 2% target”. Despite the decline in headline inflation, driven by lower energy prices, ECB president Christine Lagarde was still concerned about core inflation and expressed explicitly the intention to increase rates by another 50bps in March. Eurozone headline inflation fell in January to 8.5% but core inflation remained unchanged at 5.2%. As a result EUR denominated investment grade bonds were also in negative territory in February. Despite this, HY bonds in EUR didn’t move much as the sentiment for the European economy improved in February.

But since the failure of SVB the shake-up in bond markets was substantial. Germany’s 2-year bond yield plummeted to a low of 2.4%, as bond markets rallied sharply in response to fading expectations of further increases in borrowing costs. As a result, investment-grade EUR bonds outperformed at the start of March. High-yield bonds were under pressure as well, as in USD space, due to concerns regarding the stability of global financial system

But since the failure of SVB the shake-up in bond markets was substantial. Germany’s 2-year bond yield plummeted to a low of 2.4%, as bond markets rallied sharply in response to fading expectations of further increases in borrowing costs. As a result, investment-grade EUR bonds outperformed at the start of March. High-yield bonds were under pressure as well, as in USD space, due to concerns regarding the stability of global financial system

3. Gold

3. Gold

Gold prices in February slumped around 5.2%, nearly reverting all the gains since the start of the year. Again, as with US bonds, the main reason behind gold prices decline were renewed expectations around more prolonged rate hikes from the U.S. Federal Reserve. As a result of these expectations shift, 10-year TIPS yields in February increased 22 bps from 1,28% to 1,5%. Higher rates tend to be negative for gold, as the opportunity cost of holding the non-yielding asset increases. But in March the price action reversed due to concerns surrounding the failure of SVB and regional banks in the U.S. Gold prices again increased back to $1,900 level, and US 10-year TIPS returned to the level around 1,34%, as investors ran into safe haven assets.

3095, Cyprus, Limassol, Pindarou 14

Vita Markets

© 2023. All Rights Reserved

VM Vita Markets Ltd operates through this official website only and provides investment services via mobile application available at the following link